Your accounting department cannot scale with Quickbooks

Using Quickbooks with Excel spreadsheets will block your growth. It adds labor cost and cannot scale. It requires the Broker/Owner to accept long delays for financial reports and cannot deliver automated real-time analytics.

Many Real Estate brokerages run their accounting department with Quickbooks and a collection of Excel spreadsheets. For a small "mom-and-pop" brokerage that is small and wants to stay small, this combination of Quickbooks & Excel will work, but it cannot scale. Once a brokerage reaches 25 agents the accounting department will start to feel the strain. When a brokerage agent count goes past 40 agents, this low tech solution blocks growth. It requires additional labor cost and requires the Broker/Owner to accept long delays for financial reports and a complete lack of analytics.

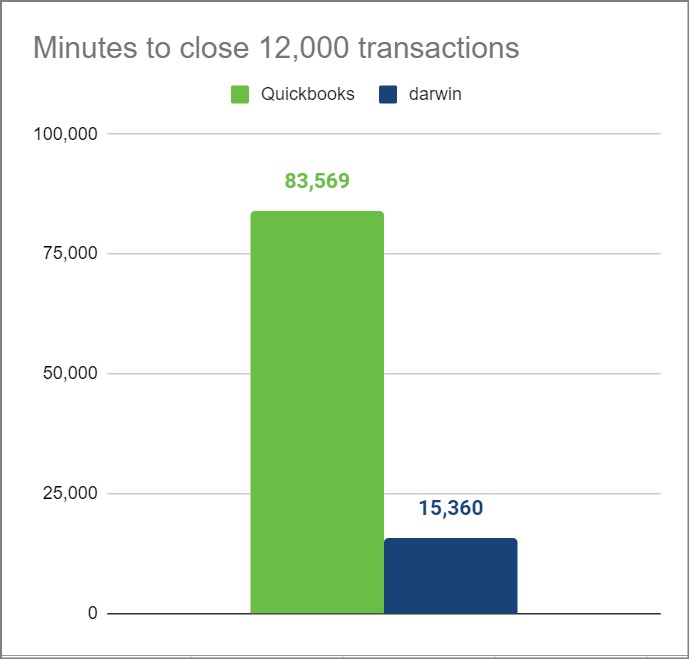

Back office accounting automation from AccountTECH lets your accounting staff close 5 1/2 transactions in the same time it takes to close 1 transaction using Quickbooks & Excel. And if your office is weighted towards teams, referrals or any circumstances that requires multiple checks to be issued per closing, then the performance differential is even higher. Read on to see how and where you can save time & money in back office accounting.

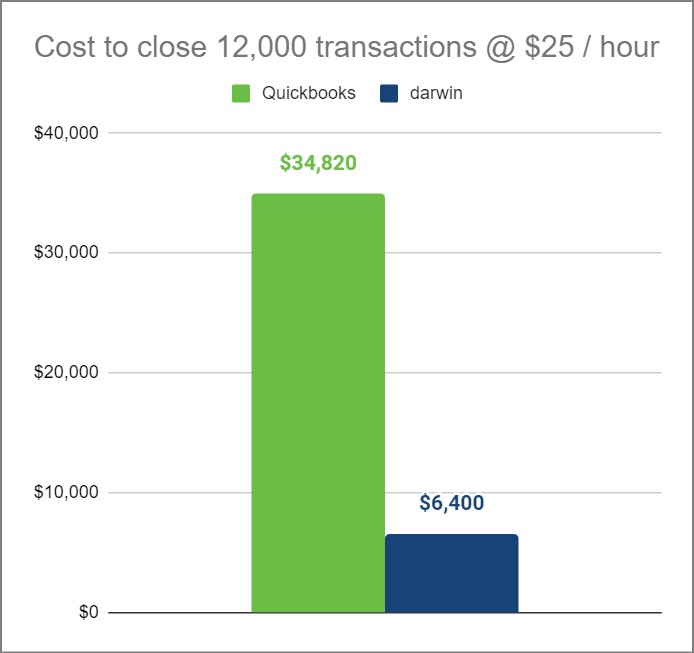

Cost to close transactions at $25 per hour:

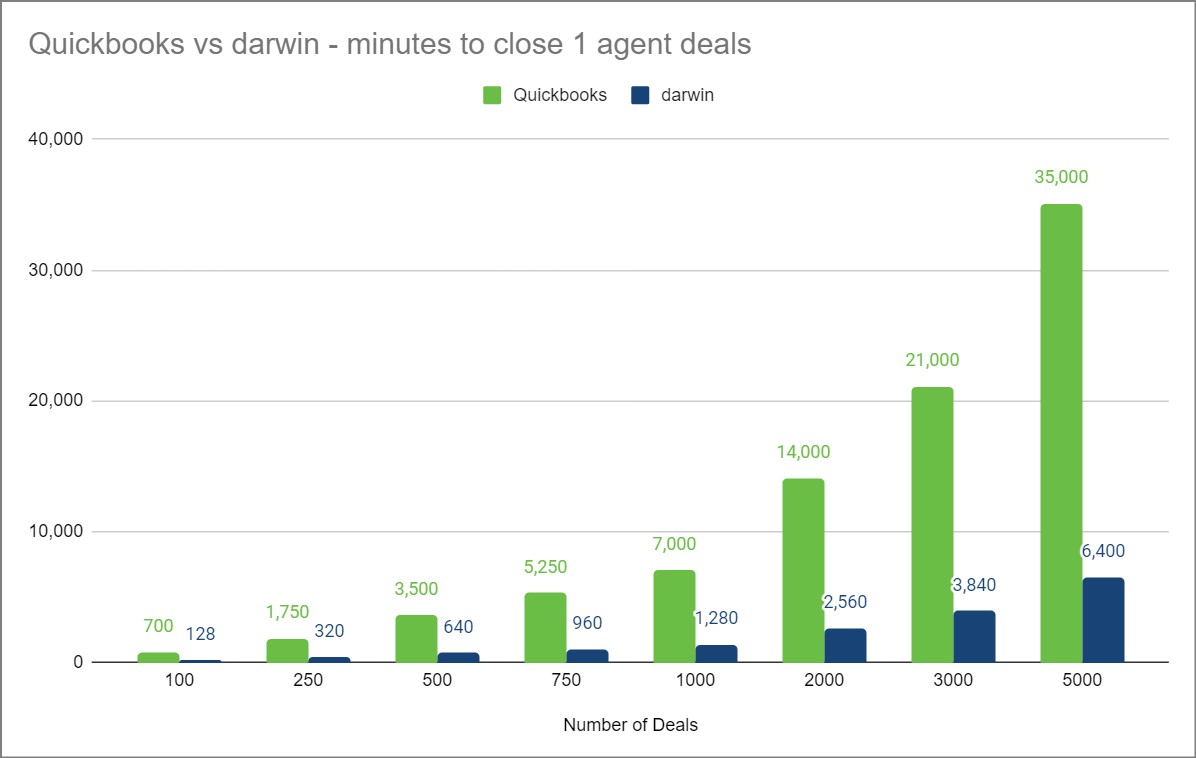

The difference is entirely related to the time it takes to manually enter accounting records (and then report them to your franchise). The graph below shows the number of minutes it takes an experienced accountant to complete all the steps needed to close a transaction. This graph shows time comparison associated with closing deals that only have one agent on the transaction.

More checks per transaction take no extra time with automation

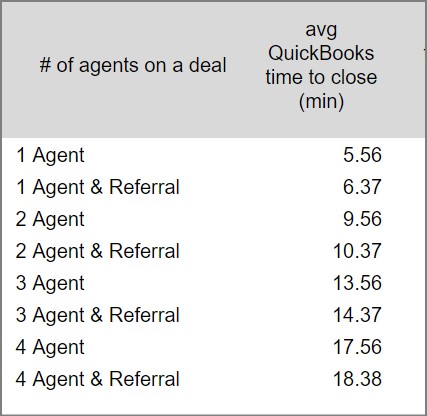

When you are making the accounting records for a closing manually with Quickbooks, it always takes more time per transaction. With AccountTECH, the time to close a transaction doesn't change - regardless of how many checks have to be written on the deal. But when you are making accounting records manually in Quickbooks & Excel, the number of agents on a deal & the number of checks to write on a deal make a major difference on the time per transaction. Here are the numbers:

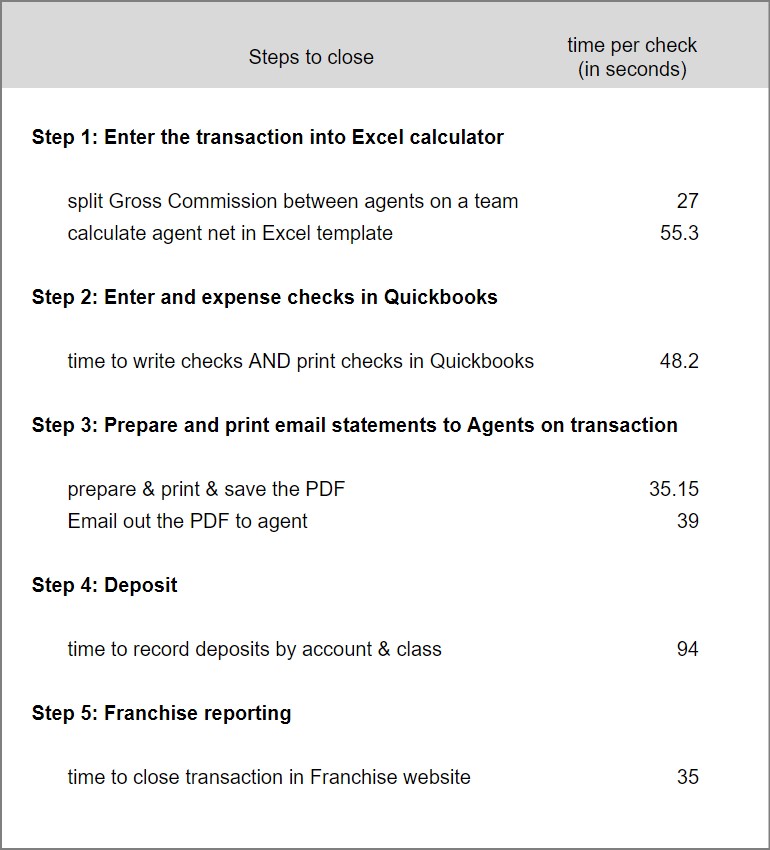

To understand the time associated with closing transactions, lets examine all the steps associated with closing transactions manually. For this example, lets imagine a closing for agents on a team with a referral off-the-top. Here is the amount of time per check to make the accounting entries:

It all adds up. Even though each step only takes a few seconds, when your office is closing thousands of checks a year the seconds add up to hours and hours of unnecessary labor and cost.

Real world example of time and labor cost savings

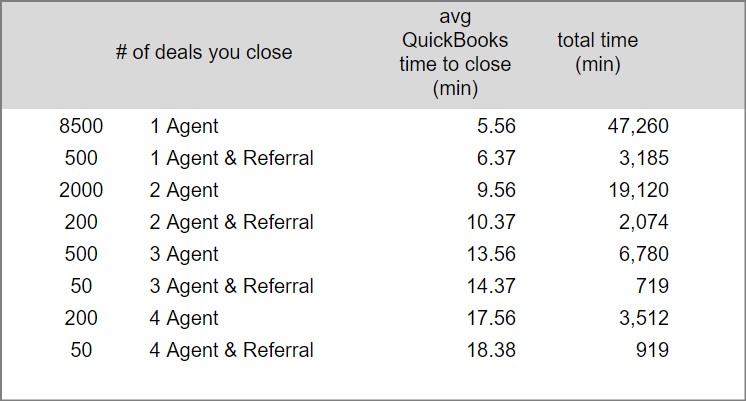

In your office, your accounting department closes all different kinds of transactions. Sometimes double-sided deals. Sometimes team deals. Sometimes with a referral. For our example, lets assume a 100 person office with each agent closing 1 deal per month. Over the course of the year different deals are going to close that need a different number of checks per deal.

So with this mix of closings, over the course of the year it takes more than 5 times as long to close the transactions with Quickbooks and Excel.

If you pay your accounting staff $25 per hour, by year end this creates a big labor cost.

Ready to evolve?

Request a demo or learn more about the power of darwin.